Bonds are generally popular as fixed-income securities and comprise one of the primary asset classes that investors are commonly familiar with, cash equivalents and stocks or equities. When companies or other business entities need to raise capital to finance a new project, maintain their existing operations, or refinance any current debt, they might issue bonds directly to the investors in the market.

The issuer releases a bond that includes the loan terms, the payments of interest that will be given to the investor, and the time the bond principal should be paid back or its maturity date. The payment of interest is known as the coupon and is a part of the bondholder’s return that they get for loaning their capital to the issuer. The rate of interest on which the payment is determined is known as the coupon rate.

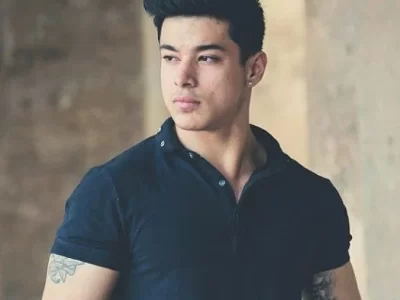

Kavan Choksi– how do bonds work for the investor?

Leading investor, business and finance expert, Kavan Choksi, states that the initial cost of a majority of bonds is generally set at par or at a $1000 face value for an individual bond. Its actual price in the market relies on many factors like the credit quality of its issuer, the time period until its expiration and the coupon rate that is compared to the general rate of interest environment during a specific time. The bond’s face value is the amount that will be given to the borrower on its maturity.

The initial holder of the bond sells most bonds in the market to other investors after their issuance. This means that the investor of the adhesive can keep it on its date of maturity. It is common for bonds to be purchased again by its borrower if there is a decline in the rates of interest or if the credit of the borrower has become better, and new bonds can be reissued at reduced prices.

Two features salient to a bond

There are two features that are salient to a bond, and they are the maturity time and the credit quality. These two components determine its coupon rate. If the issuer has a credit rating that is poor, the risks of its default are higher, and these bonds pay out more interest.

Bonds having a maturity date that long generally pays higher rates of interest. This rise in compensation is due to the bondholder getting a higher rate of interest and risks inflation for a more extended period.

How are credit ratings for companies determined?

The credit ratings for any company and the bonds it releases in the market are determined by agencies that specialize in credit ratings like the Fitch Ratings, Moody’s, and Standard and Poors. Those bonds that have the highest quality are known as investment grade, and they include bonds that are released by the Government of the USA and other companies known for their strong stability in the market, for instance, several public utilities in the nation.

Business and finance expert Kavan Choksi states that those bonds not marked as investment grade but not default in nature are known as high-yield bonds or junk bonds because they have a higher risk for default, and the payment for the coupon is more to compensate them for that risk.

![How to fix [pii_email_35800da0131beebe44e2] Outlook Error Code?](https://thefantasticbeasts.com/wp-content/uploads/2023/03/Pii-Errors-pii_email_-1-400x225.png)

![How to fix [pii_email_35800da0131beebe44e2] Outlook Error Code?](https://thefantasticbeasts.com/wp-content/uploads/2023/03/Pii-Errors-pii_email_-1-180x180.png)

Comments